Articles

Home Loan Pre-EMI vs Full EMI: A First-Time Homebuyer’s Guide

Buying your first home? Congratulations – it’s a big milestone! But amidst the excitement, there’s one decision that often confuses new buyers: What Pre-EMI or Full EMI on my home loan? If these terms sound like banking jargon, don’t worry – you’re not alone.

When Should You Consider a Home Improvement Loan? A Practical Guide

Home evolves with time.

How to Check Land Records Online Using ULPIN

Land ownership disputes and fraudulent sales remain some of the biggest hurdles for property buyers in India.

RBI’s Home Loan Rules & Outlook: Repo Cut, Prepayment Freedom & What Borrowers Must Know

In December 2025, decided to cut the repo rate by 25 basis points that brought the benchmark down to 5.25%.

The Impact of EBLR & MCLR on Your Home Loan Explained

On 6 August 2025, The Reserve Bank of India unanimously decided to pause its repo rate at 5.50%.

Step-by-Step Guide on How to Check Karnataka RERA Registration Number Online

The Real Estate (Regulation and Development) Act, 2016 (RERA) was enacted to bring accountability and transparency to India’s real estate sector.

The Importance of Property Insurance When Taking a Home Loan

A home loan is a long-term financial commitment often spanning between 10 to 20 years, or even more.

Need Extra Funds? Here’s Why a Pre-Qualified Top-Up Home Loan May Be the Answer

Life doesn’t come with a warning. Whether it’s a sudden medical bill, your child’s higher education, or long-overdue home renovations, unexpected expenses can put anyone under emotional and financial pressure.

How to Calculate Home Loan EMI via EMI Calculator and Excel Sheet

Before applying for a home loan, it’s important to know exactly how much you’ll be paying each month, and that’s why you need to calculate home loan EMI beforehand to know exactly how much you are being committed to.

Co-Applicant in Home Loan: Benefits & Rules You Should Know

Buying a home is often a family decision, and financially, it can be a big one. To make it easier, many people apply for a joint home loan by adding a co-applicant.

Decoding Banking Jargons: What is Amortization Schedule?

Mr. X, a 32-year-old IT professional in Pune, finally decided to buy his dream 2BHK flat. After months of site visits, he zeroed in on a ₹75 lakh apartment and got a home loan of ₹50 lakhs for 20 years at an interest rate of 8% p.a. He decided to make a down payment of the remaining ₹25 lakh from his own pocket.

Home Loan Transfer Process in India: Step-by-Step Guide to Switching Your Loan Account to Another Bank

A home loan is a long-term commitment, and over time, your financial needs or market conditions may change.

Can You Get a Home Loan Without Down Payment?

Buying a home is one of the biggest financial milestones in life. For most Indians, this dream is realised through a home loan, which helps spread the cost of the property over several years.

Home Insurance vs Home Loan Insurance: A Detailed Guide

As of September 30, 2024, total outstanding individual housing loans stood at ₹33.53 lakh crore (₹33.53 trillion), marking a 14 % YoY increase amid a post‑pandemic housing boom.

Is There Any Penalty If You Foreclose or Prepay Your Home Loan?

Did you know nearly 40% of home loan borrowers in India prefer prepaying their loans partially or fully within the first 10 years to save on interest costs? With rising financial awareness and better income visibility, prepaying a housing loan has become a go-to strategy for faster debt freedom.

What is In-Principle Approval in Home Loan?

Buying a home is one of the biggest financial decisions most people make in their lifetime. While shortlisting properties and budgeting are crucial steps, securing a home loan is often the key that unlocks the dream of homeownership.

Top Government Housing Schemes for First-Time Home Buyers in India (2025 Guide)

For first-time homebuyers, the process of purchasing a home can be overwhelming due to increasing property prices and complex loan eligibility requirements.

7 Steps to Get Started Your Home Loan Application Process in India

Buying a home is one of the biggest dreams for most of us. But with rising property prices, it's not always possible to pay the full amount upfront. That’s where a home loan in India becomes a helpful option.

Is Closing Your Home Loan Early Good or Bad for Your Credit Score?

In the world of personal finance, owning a home is often seen as the pinnacle of financial stability.

Telangana Housing Board & KPHB Colony: A Guide to Affordable Urban Housing in Hyderabad

As Telangana continues its rapid urbanisation journey, two key housing entities—Telangana Housing Board (THB) and Kukatpally Housing Board Colony (KPHB)—have played critical roles in shaping the state's real estate ecosystem.

Explained: Can NRIs Buy an Agricultural Land in India?

Real estate investment is often a top priority for Non-Resident Indians (NRIs) looking to retain strong financial ties to India.

Are You Eligible for Section 80EE or Section 80EEA Tax Benefits?

Imagine this: Ravi, a young IT professional in Bangalore, has just booked his dream home. While planning his finances, he hears about tax benefits under Section 80EE and Section 80EEA but is confused about which one applies to him.

MHADA Lottery Scheme in Maharashtra: A Complete Guide

The Maharashtra Housing and Area Development Authority (MHADA) plays a pivotal role in providing affordable housing to various income groups in Maharashtra.

Closing Your Home Loan? Don’t Miss These Crucial Steps for a Hassle-Free Process!

Closing a home loan feels like a major achievement. It signifies the end of years of commitment and the beginning of a debt-free life.

Settlement Deed in Property Transactions: A Complete Guide

A Settlement Deed is a legal document used to distribute property among family members or beneficiaries amicably.

Letter of Intent in Loans: Everything You Need to Know

When applying for a loan, especially a high-value one such as a business loan or mortgage, a Letter of Intent (LOI) plays a crucial role. It acts as a preliminary agreement that outlines the key terms and conditions before finalizing a formal loan contract.

Loan Against Property vs Personal Loan: Which One is Right for You?

When faced with a financial need—whether it's for business expansion, medical emergencies, or debt consolidation—you may find yourself choosing between a Loan Against Property (LAP) and a Personal Loan.

Domicile Certificate: A Complete Guide

A domicile certificate is an official document issued by the state or union territory (UT) government to certify that an individual is a permanent resident of that particular state or UT.

Home Loan Restructuring vs. Refinancing: Choosing the Right Path for Financial Relief

Amit and Ravi, two childhood friends, found themselves in similar situations but chose different paths to navigate their financial difficulties.

Partition Deed: A Complete Guide to Property Division in India

Property disputes among family members are common in India, often leading to lengthy legal battles. A Partition Deed is a crucial legal document that helps co-owners divide their jointly owned property amicably, avoiding unnecessary conflicts.

What is EBLR and How Does it Impact Your Home Loan?

Interest rates play a critical role in determining the cost of loans, and for Indian borrowers, the shift to External Benchmark Lending Rate (EBLR) has been a game-changer.

What is PMMY? A Game-Changer for India’s Small Enterprises

Launched on April 8, 2015, the Pradhan Mantri Mudra Yojana (PMMY) is a flagship government initiative designed to “fund the unfunded.”

Does RBI’s Repo Rate Change Affect Your Home Loan Interest Rate?

On 5 December, 2025, the Reserve Bank of India (RBI) took a decisive step to stimulate economic growth by cutting the repo rate by 25 basis points, bringing it down to 5.25%.

The Ultimate Guide to No Objection Certificate (NOC) for Loans

Let’s assume that you’ve finally finished repaying your home loan or car loan after years of disciplined EMI payments.

How to Save Tax on Rental Income: Tips and Strategies

With India’s rental housing market projected to grow at a CAGR of 5.3% from 2023 to 2028, more individuals are investing in rental properties. According to a recent report, around 28% of urban dwellers in India live in rented accommodations.

What Is FOIR and How It Can Impact Your Loan Approval?

When you apply for a loan, your financial health plays a key role in determining whether your application is approved.

Consider These Do’s and Don’t Before Applying for a Home Loan

A home loan is a long-term commitment that requires careful planning and financial prudence. Making informed decisions before applying for a home loan can save you from unnecessary financial strain in the future.

A Comprehensive Guide to Patta Chitta

In Tamil Nadu, land records are important for establishing ownership and ensuring transparency in property transactions.

Tenancy Agreements: Meaning, Rights and Reasons for Disputes

Tenancy agreements are legally binding contracts that specify the terms of occupancy between a tenant and a landlord.

Fixed-Rate Home Equity Loan vs HELOC: Which is Better?

Are you contemplating leveraging your home equity but find yourself tangled in the web of choices between a fixed-rate home equity loan and a Home Equity Line of Credit (HELOC)? You're not alone!

A Comprehensive Guide to Conveyance Deed

When it comes to real estate transactions, clarity and legal documentation are paramount. One such critical document is the Conveyance Deed.

How to Save for Down Payment on Your Home: A Complete Guide

Banks in India generally finance up to 85% of a property's value, leaving you to cover the remaining as a down payment.

Gold Loan Vs Home Loan: Making the Right Choice

Both gold loan and home loan are secured loans – you have to pledge collateral to get a loan.

Understanding the Reverse Repo Rate: A Key Component of India's Monetary Policy

On 9 June 2025, the Reserve Bank of India (RBI) cut the repo rate by 50 basis points, marking the third rate cut in 5 years. The current repo rate stands at 5.25% and the reverse repo rate at 3.35%.

What is EMI and How is it Calculated?

Imagine standing at the showroom, eyeing the latest scooter or a brand-new car.

Complete Guide to BBMP e-Khata Bangalore

Managing property records in Bangalore has always been a cumbersome task, often involving endless paperwork and manual processes.

A Comprehensive Guide on Mortgage Deed and Its Importance

The demand for home loans in India has surged by over 15% in 2024, largely driven by low-interest rates and the growing middle-class population.

10 Smart Ways to Reduce Your Home Loan EMI

Buying a home is a dream come true for many. But the financial burden of a hefty home loan EMI can be overwhelming.

What Happens If You Miss a Home Loan EMI? Consequences and Solutions

Owning a home is a cherished dream for many. A home loan often makes this dream a reality by providing the financial assistance required to purchase a property.

Land Survey Number: A Complete Guide on How to Find and Verify It

Buying land is a significant investment, and ensuring the legality of the property is crucial. One of the essential elements in verifying land ownership is the Land Survey Number.

What is a Home Loan Top-Up?

If you’re repaying a home loan and need additional funds for purposes like home renovation or upgrading your property, a home loan top-up could be the ideal solution.

9 Easy Ways to Reduce Home Loan Interest Rates

Did you know that even a 1% reduction in your home loan interest rate can save you thousands, if not lakhs, of rupees over the loan tenure?

What is Gift Deed?

Gift-giving is a cherished tradition in Indian culture, symbolizing generosity and goodwill.

Home Insurance vs Home Warranty: Key Differences Explained

Owning a home is a dream come true for many. It's where we build our lives, create memories, and find solace.

The Multiple Benefits of a Joint Home Loan Explained

Taking joint Home Loan has several advantages. You not only get to share the repayment obligations with the co-borrower (generally, spouse or any other immediate family member), you can also save more on your taxes.

Leveraging Property for Financial Growth: How to Make More Money

Investing in real estate has become a popular choice for diversifying investment portfolios and increasing net worth.

7 Smart Strategies to Repay Home Loan Faster

Managing and repaying your home loan faster, not only improves your financial stability, but can also save you money in the long term.

Best Home Renovation Tips for 2025

With the New Year around the corner, it’s time to keep that checklist ready. If renovating your house has made it to your list of items to tick off in 2025, keep reading this blog.

Preparing to Buy a House? Follow These Steps

Buying a house is arguably one of the most significant milestones in life. For many, it represents stability, achievement, and personal progress.

How Prepaying Your Home Loan Can Help You Save on Interest

In on of the blogs, we have outlined how home loan part payment works. Your Home Loan,, barring processing fees, has two components – the principal amount (the loan amount disbursed) and the interest component

How to Use Home Loans for Buying a Second House or Vacation Property

Dreaming of having a second home or vacation property? Many people aspire to have a space they can retreat to and enjoy leisure time with their loved ones.

Using Technology for Home Buying Research

In today's digital era, technology has revolutionised almost every aspect of our lives, including how we buy homes.

Home Loan vs HRA: Which One Can Help You Save More on Tax?

Both home loan and HRA (House Rent Allowance) come with tax benefits, albeit under different Income Tax laws.

Know The Benefits of Buying a Home Before Turning 30

Buying a home is one of the most significant milestones in anyone's life.

Home Loan Processing Fees and Charges

Thinking about getting a home loan? Well, there’s a little more to it than just comparing interest rates.

How to Use RERA to Check Project Details

Buying a home is a dream for many, but it can be slightly overwhelming for few. From finding the right property to getting home loan approval, there are several factors to consider.

Should You Rent or Buy a House with Home Loan?

The decision to buy or rent a house is one of the most significant financial choices you'll make. It impacts not just your current lifestyle but also your long-term financial stability.

The Role of Property Valuation in Home Loan Approval

As you embark on your home buying journey, understanding the role of property valuation in the home loan approval process is crucial.

8 Tips to Consider to Afford a House in 2025

Buying a house is a milestone many of us aim to achieve. However, the financial aspect of purchasing a home can seem daunting.

How to Transfer Property Ownership in India: A Comprehensive Guide

With all the legal formalities involved. transferring property ownership in India could be slightly challenging if you aren’t aware of the nitty-gritties of it.

A Complete Guide to Property Tax

Property tax, also known as house tax, is levied by municipal authorities in India on real estate properties.

Understanding the Process of Home Loan Legal Verification

When it comes to buying a home, there are several important steps in the process that must be followed.

Tips to Manage Your Home Loan During Financial Crises

Managing a home loan during financial crises can be overwhelming, but with the right strategies, it is possible to navigate through challenging times without compromising your financial stability.

A Comprehensive Guide to Repo Rate and How it Works

Have you ever noticed that sometimes home loans become more expensive, or that the interest on your Fixed Deposit changes, even though you didn't do anything differently?

MCLR vs Repo Rate in Home Loan: Understanding the Difference

Did you know that even a subtle 0.25% change in the Reserve Bank of India's (RBI) repo rate can ripple through the entire economy, affecting everything from your home loan EMI to the interest on your business loan?

Decoding Stamp Duty and Registration Charges in Karnataka

Did you know that the Karnataka Stamps and Registration Department generated a record revenue of ₹20,837 crore this year?

Home Loan Tax Benefits Under Section 80EEA of the I-T Act, 1961

One of the significant advantages of availing a Home Loan is that you can enjoy multiple tax benefits that helps in reducing your tax outgo.

What is Relinquishment Deed in Property Transactions?

A relinquishment deed is a legal document used when someone gives up their rights or ownership of property or asset.

MCGM Property Tax: How to Pay Property Tax in Mumbai

MCGM stands for Municipal Corporation of Greater Mumbai. Residents of Mumbai are mandated to pay property tax every year towards MCGM.

BBMP Bangalore Property Tax: Everything You Need to Know

According to the Bruhat Bengaluru Mahanagara Palike (BBMP) data, there are around 2.64 lakh property owners who are yet to pay property tax.

Property Market Rates vs Circle Rates: What You Need to Know

When you’re considering buying a property, understanding the financial landscape is crucial.

Difference Between Co-Signer and Co-Applicant in Home Loan

When securing loans, particularly Home Loans, you’re either a co-applicant, co-owner, co-borrower or co-signer.

Difference Between Home Equity Loans and Home Loans: Which is Right for You?

Whether you're planning to buy a new home or need funds for other purposes, financing options like home equity loans and home loans can help you achieve your goals.

Understanding the Role of Home Loan Agents and Brokers

Buying a house is a significant decision that requires careful financial planning. With home loans for properties above ₹75 lakh surging in the past four years

How to Get a Home Loan After Retirement

The senior living market in India is predicted to increase significantly from its present $2–$3 billion size to about $12 billion by 2030, due to the ageing population of the nation.

6 Tips to Save Property Tax

Are you looking for ways to save on property tax? Property tax is a mandatory charge collected by municipal authorities in India, used for maintaining local infrastructure and civic amenities.

Home Loan Tax Benefits Under Section 24(b)

Section 24(b) of the Income Tax Act allows homeowners claim tax deductions for the interest paid towards their home loans.

Home Loan Tax Benefit Under Section 80C of the Income Tax Act

Are you aware your Home Loan could help you save up to ₹1.5 lakh on your annual taxes under Section 80C of the Income Tax Act?

Understanding RERA Act: How It Protects Homebuyers in India

The Indian real estate sector is poised for transformative growth over the next decade, fuelled by demographic shifts, economic development, and changing consumer preferences.

How to Choose the Right Type of Home Loan Based on Interest Rate

There are two types of Home Loan interest rates – fixed rate and floating rate home loans.

What is a Sale Deed in Property Transactions?

A sale deed is an important document that not only signifies the transfer of property ownership but also protects the rights of both the parties (buyer and seller) involved in the transaction.

How to Transfer B Khata to A Khata

Are you a property owner in Bangalore? If so, you might have come across terms like B Khata and A Khata during your real estate journey.

Home Loan Financial Planning: Best Budgeting Tips and Loan Preparation Ideas

Applying for a home loan requires careful planning, especially when it comes to managing your finances.

What is an Encumbrance Certificate and Why Do You Need It?

Are you planning to buy or sell a property? Or maybe you're applying for a loan against your property? In any of these scenarios, obtaining an Encumbrance Certificate (EC) is essential.

How to Use Home Loans for Property Investment

The real estate sector has always been a lucrative sector for investments. It offers the potential for long-term wealth creation and financial security.

A Guide to Home Loan Origination Fees

The process of securing a home loan can be complex and overwhelming, especially when it comes to understanding the various costs involved.

How to Buy a Property in an Underdeveloped Area Using a Home Loan

When it comes to buying property in underdeveloped areas, there are specific considerations to keep in mind. There’s a lot of research and legalities involved if you’re planning to buy a property in areas that are not fully developed.

How to Ensure Smooth Home Loan Processing with Proper Documentation

Navigating the home loan process can be slightly overwhelming, especially if you're a first-time homebuyer. From filling out application forms to submitting documents and waiting for approval, there are several steps involved.

How to Negotiate the Best Home Loan Deal With Your Bank

Mr. Sharma is looking for a home loan of ₹50 lakhs for a tenure of 20 years. Bank A offers an interest rate of 8% with a processing fee of 1% and no prepayment charges.

How to Buy a Foreclosed Property Using a Home Loan?

Are you dreaming of becoming a homeowner? Purchasing a property is a significant milestone, but it can be challenging to find the right one within your budget.

The Role of Loan Pre-Approval in Securing the Best Home Loan Deals

Banks generally offer funds which is up to 80% of the total cost of the property.

6 Smart Home Loan Repayment Strategies for Women

In March 2024, a report released by credit bureau CRIF High Mark revealed that the share of women home loan borrowers stood at 33%.

Key Difference Between Secured and Unsecured Loans Explained

If you do a bit of research on loans, you will find two categories – secured and unsecured.

How to Avail Tax Benefits on Joint Home Loans

Did you know that taking a joint home loan with your spouse or a family member can offer significant tax benefits? In this article, we will explore the various tax benefits on joint home loans and how you can make the most of them.

Difference Between Construction Loan and Home Loan: What You Should Know

Planning to take a home loan? Before you apply, know your purpose first. In India, there are different types of home loans available with each offering financing for a particular purpose.

How to Use Your Home Loan to Buy a Vacation Home in India

What if you had a second home located in your favourite place – a home that’s solely meant to spend quality time with your family? Yes, we’re talking about vacation home.

Difference Between Sale Deed and Conveyance Deed

When buying or selling property, paperwork can be overwhelming. Understanding legal jargons is critical to avoid future complications.

Home Loan Sanction Letter: Meaning and Importance

Navigating the complex world of home loans can be overwhelming without the right information. One important aspect is to understand the role of a home loan sanction letter.

Joint Home Loan Management: Tips for Managing a Shared Loan with Your Spouse

Raj and Simran want to buy their dream home. They decide to apply for a joint Home Loan with equal ownership.

Top 10 Home Loan Myths Debunked

Buying a house is a dream for many, and a home loan can make this dream a reality. However, there are several common misconceptions and myths surrounding home loans that may discourage you from taking this step.

How to Save Capital Gains Tax on Property Sales

Are you wondering about the impact on your taxes after the government's recent change in the capital gains tax regime for real estate?

Difference Between Freehold and Leasehold Properties

If you're foraying into home ownership or real estate investment, you will come across two terms - freehold property and leasehold property.

How to Avail Home Loans Under PMAY for Interest Subsidy

Government schemes like Pradhan Mantri Awas Yojana (PMAY) - Credit Linked Subsidy Scheme (CLSS), has made affordable housing a reality.

How to Ensure Smooth Property Registration

For a first-time home buyer, the process of property registration can seem daunting at first. However, with the right understanding and adequate preparation, you can ensure a smooth property registration experience.

How to Use Your Home Loan for Purchasing Commercial Property

Thinking of venturing into the world of commercial real estate? You're not alone. Many individuals dream of owning a commercial property as it offers lucrative opportunities for businesses and investments.

How to Clear Property Title Disputes Before Applying for a Home Loan

Before you can apply for a home loan, it is crucial to ensure that the property you wish to purchase has a clear title. Property title disputes can create legal obstacles and financial risks

Legal and Financial Aspects of Buying Agricultural Land in India

Investing in agricultural land is an attractive option for many individuals in India, offering the potential for high returns.

How to Transfer Your Home Loan to Another Bank for Better Rates

Did you know that the RBI has kept repo rate unchanged at 6.5%, the ninth time in a row? A change in the repo rate may affect your interest rates if you have a home loan with a floating interest rate.

What is the Difference Between Home Loan and Mortgage Loan

We have different types of Home Loans designed to serve different purposes.

Understanding Sub-Registrar’s Role in Property Transactions

Buying or selling a property involves exhaustive legal processes that must be carefully followed to ensure a smooth and legitimate transaction.

Understanding Circle Rates: How They Impact Property Transactions

Buying or selling a property can be a complex process, with many factors to consider. One essential element that both buyers and sellers need to understand is the concept of circle rates.

Difference Between Under Construction Vs Ready-to-Move-In Property Loans

Are you considering buying a property in India but confused about whether to opt for an under construction vs ready-to-move-in property loans? You're not alone. Many individuals face this dilemma when purchasing a home.

Difference Between Home Loan and Loan Against Property

Owning a home is a dream for many individuals, but it often requires financial assistance in the form of loans.

How to Use Your Home Loan for Home Improvement Projects

Planning to renovate your house but short on cash? Instead of taking a high-interest personal loan that can put a strain on your finances, avail a Home Improvement Loan.

The Impact of Your CIBIL Score on Home Loan Approval

Getting a Home Loan is not just about meeting income and employment criteria; banks also consider your credit or CIBIL score to determine your creditworthiness.

Understanding Home Loan Foreclosure and Part Payment: Pros and Cons

Let’s assume you’ve taken a home loan for a tenure of 20 years. You’re paying EMIs (Equated Monthly Instalments) against your home loan every month.

What is a Mutation Certificate and Why Is It Important?

Property ownership in India involves several legal processes and documentation, including acquiring a Mutation Certificate

Difference Between Home Loan and Land Purchase Loan Explained

In India, there are different types of Home Loans, like house purchase loan, home construction loan, plot loan (land purchase loan), home improvement loan, etc. Each of these loans serves a specific purpose.

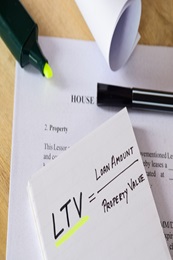

What is Loan-to-Value (LTV) Ratio?

If you're a first-time homebuyer and planning to apply for a home loan, you will come across a term LTV or Loan-to-Value ratio. First thing first - till date, no bank in India has offered 100% financing of the property value.

Government Subsidy Schemes for Home Loan: Interest Rate and Eligibility

The Government of India is on a mission to make housing affordable for all. To realise the initiative 'Housing for All', the Government launched subsidy schemes for home loans like Pradhan Mantri Awas Yojana (PMAY) in 2015 - an initiative that aims to make the concept of affordable housing a reality.

Tips for First-Time Home Buyers Applying for a Home Loan

Let's take inspiration from Neha, a first-time homebuyer who successfully secured her dream home with a Home Loan.

What are the Stamp Duty Charges in India?

Buying a property is an essential milestone in our lives, but it comes with its fair share of financial obligations. Apart from the EMI (Equated Monthly Instalment), additional charges like stamp duty, registration fees, legal fees, and home loan charges must be considered.

Title Deed of Property and Its Importance Explained

When it comes to buying or selling a property, one of the most crucial aspects is understanding the role of a title deed. A title deed is a legal document that establishes proof of ownership for a property.

What are The Different Types of Home Loans?

Are you planning to buy a house or a plot? Or are you planning to renovate your existing house? because there are different types of Home Loans designed to serve different purposes.

Key Documents Required for NRI Home Loans

After COVID, there has been a noticeable increase in the desire of NRIs to invest in real estate in India, not simply because of emotional -

Understanding the Role of Power of Attorney in Property Transactions

As you begin your journey into the world of real estate, it's crucial to understand the role of power of attorney in property transactions.

Understanding Property Transfer Charges in India

When you buy a property, it is not only the purchase price that you should look at. Beyond the purchase price, there are additional charges to consider such as transfer charges, property taxes, and legal fees.

Important Factors That Affect Home Loan Interest Rate

Are you also dreaming of owning a home? Thanks to affordable home loans and PMAY (Pradhan Mantri Awas Yojana – a scheme that offers interest subsidy to low- and mid-income earners)

Top Factors That Can Influence Your Home Loan Eligibility

Imagine Mr. X, a young professional with a stable job, applying for his first home loan but is surprised when his application is denied.

What to Do If Your Home Loan Application is Rejected?

Facing rejection can be disheartening, especially when it comes to your dream of owning a home.

Fixed vs Floating Home Loan Interest Rate Explained

When applying for a Home Loan, you have the option to choose between fixed and floating interest rate. Choosing any of the two can have a significant impact on your EMI (Equated Monthly Instalments).

How to Avoid Common Home Loan Application Mistakes

Buying a home is a significant milestone. However, navigating the home loan application process can be complex and overwhelming, if you're not well-informed. This may lead to common mistakes that could hinder your loan approval.

How to Apply for a Home Loan with Low CIBIL Score

Dreaming of owning a home is something we all dream of, but if your CIBIL or credit score is less than average, that dream might feel a bit out of reach.

How to Handle Home Loan Defaults and What to Expect

If you've taken out a Home Loan, it's important to understand the consequences of defaulting on your payments. A home loan default occurs when you fail to make your scheduled monthly payments for an extended period of time. This can happen due to various reasons such as financial difficulties, job loss, or unexpected expenses.

What is the Role of Stamp Duty and Registration Fees in Home Loan?

The process of financing a home can be complex and overwhelming, especially when it comes to understanding the role of stamp duty and registration fees. In this article, we will demystify these charges and provide you with a comprehensive guide to help you navigate through the property purchase costs and the charges involved.

How to Refinance Your Home Loan for Better Terms

Owning a home is a dream shared by many, but managing the financial aspects of it can be overwhelming.

The Impact of Interest Rate Changes on Your Home Loan

The Impact of Interest Rate Changes on Your Home Loan Home loan borrowers have been severely impacted by the increase in interest rates and consequently higher EMIs compared to just 28 months ago.

Home Loan Tax Benefits (FY 2025-2026) Explained

One of the key advantages of taking a home loan is the array of tax benefits it provides. You can claim deductions on both the principal and interest paid during a financial year. For those unfamiliar, home loan tax deductions are available under Sections 80C, 80EE, 24(b), and 80EEA, subject to specific terms and conditions.

A Complete Checklist of Documents Required for Home Loan

The road to homeownership is a fascinating journey. Lots of planning, plenty of brainstorming, mulling over decisions, etc., the entire process may seem like a rollercoaster ride, especially when it comes to choosing the right financier.

Home Loan Benefits and Eligibility Criteria

Owning a home is a dream for many, and home loans have made this dream more achievable. Leaving aside the home buying aspect, home loans come with additional benefits like tax savings.

Taking a Home Loan in Your 40s: Key Considerations

Buying a home is a significant milestone, especially in your 40s when you have more financial stability and clarity about your long-term goals.

Navigating Home Loan Disbursement Successfully

Navigating the journey of home loan - from approval to disbursement - can be thrilling yet daunting.

Latest Blogs

Why Borrowers May End Up Paying Higher Interest Than Expected?

In India, access to credit has expanded significantly.

Loan Prepayment vs Investing Extra Money: What’s Smarter?

Most people reach this dilemma at the same moment: the EMI is running smoothly, income has stabilised, and there is a little extra money left every month.

What Happens to Your Savings During Inflation?

India’s latest official data shows retail inflation (CPI, combined) at 1.33% year-on-year for December 2025, up from 0.71% in November 2025

What Happens If Your Mobile Number Is Not Linked to PAN or Aadhaar?

Mobile numbers in the PAN–Aadhaar ecosystem have become a key access point.

Mutual Fund Taxation in India: Residents & NRIs

This article is for general information/education and is not investment advice.

Checklist Before You Buy Property: Title, Approvals & Documents

Buying a property has long been a major financial decision and investment.

Income Tax Saving Options Before 31st March: Smart Moves

March-end tax planning works best when it is treated as a compliance exercise, not a last-minute buying exercise.

What Is NIFTY?

This article is for general information/education and is not investment advice.

What is SIP? A Beginner’s Guide to Systematic Investment Plan

Investing in mutual funds often feels complicated - when to invest, how much to invest, and whether the market is “right.” A Systematic Investment Plan (SIP) simplifies all of this.

Difference Between SIP and Lump Sum Investment: A Complete Guide

India’s mutual fund industry has seen sustained growth, driven largely by rising retail participation.

Mutual Fund 101: How Mutual Funds Work, Types, Risks, Costs, and Key Concepts

Investing often feels complex when you’re starting out.

Home Loans vs Other Section 80C Tax-Saving Options

Taking a home loan is primarily a long-term ownership decision.

Form 16, AIS & TIS Explained: What to Check Before Filing ITR

Filing an income tax return is usually smooth when three parts match.

Financial Year-End Checklist for Individuals: What to Do Before 31 March

March is when money decisions start happening.

Last-Minute Tax Planning Mistakes to Avoid

For regular taxpayers, the first tax shock usually leads to routine planning.

Gratuity in India: Eligibility, Rules (Old vs New), Calculation & More

Gratuity is a lump-sum benefit paid by employers to employees as a reward for long-term service.

Microcredit Vs Microfinance: What’s The Difference?

Microcredit is essentially one financial product, a small loan.

Common Monthly Average Balance Issues & How to Fix Them Quickly

If you’ve ever opened your banking app and spotted a “non-maintenance charges” debit (often with GST added), you’re not alone.

Central KYC (CKYC) Guide: Step-by-Step Process to Register & Find Your CKYC Number

If you’ve ever opened a bank account, bought insurance, or invested in a mutual fund, you’ve probably had to fill out a KYC form — often more than once.

The Psychology of Gold: Why Indians Trust Investing in Gold

Long before mutual funds and stock tickers became part of everyday conversation, gold had already earned its place as India’s most trusted form of wealth.

Section 80C Explained: Best Tax-Saving Investments for FY 2025-26

Paying tax often feels like giving away a part of your hard work.

Can You Change Your Loan Repayment Date? Everything Borrowers Should Know

Loan repayment is not only about affordability.

Debt Consolidation Loans in India: Best Options, Interest Rates & Eligibility

When several loans run together, due dates overlap and repayment cycles may differ.

Tamil Nadu TN e-Services: How to Check Land Records Online in Tamil Nadu

Land ownership is one of the most valuable assets for individuals and families in Tamil Nadu.

How to Raise a Complaint and Recover Funds for Accidental Transfer to the Wrong Account

Accidentally sending money to the wrong person can feel like a heart-drop moment.

Compound Interest in Banking: How It Makes Your Money Grow

When people save or invest money with a bank, they usually focus on one number, the interest rate.

How to Verify Project & Agent Registration under AP-RERA in Andhra Pradesh

Buying a property is one of the biggest financial decisions most people make.

Home Loan Pre-EMI vs Full EMI: A First-Time Homebuyer’s Guide

Buying your first home? Congratulations – it’s a big milestone! But amidst the excitement, there’s one decision that often confuses new buyers: What Pre-EMI or Full EMI on my home loan? If these terms sound like banking jargon, don’t worry – you’re not alone.

Simple Interest vs Compound Interest: How to Compare Returns Easily

When users compare financial products, they usually look at just one parameter - the interest rate.

When Should You Consider a Home Improvement Loan? A Practical Guide

Home evolves with time.

How to Reduce Your Gold Loan Interest Rate: 7 Smart Tips to Save Money

Gold loans are one of the fastest and most practical ways to access short-term funds, whether it’s for medical needs, business working capital, education fees, or urgent home expenses.

New NPS Rules 2025: Exit, Withdrawal, And Age-Limit Changes Explained

The PFRDA has amended the “Exits and Withdrawals” rules for the National Pension System.

New RBI Updates For Basic Savings Bank Deposit Accounts: What You Need To Know

A Basic Savings Bank Deposit (BSBD) Account is a savings account intended to provide affordable banking access.

NCT Delhi RERA Portal: How to Check Registered Projects & What the Developer Fee Structure Means

Buying a home or investing in a property in Delhi is not just an emotional decision—it is a long-term financial commitment.

UP RERA: A Complete Guide to Project Registration, Developer & Agent Fees in Uttar Pradesh

The real estate landscape in Uttar Pradesh has transformed significantly since the introduction of the Real Estate (Regulation and Development) Act, 2016. With this, the Uttar Pradesh Real Estate Regulatory Authority (UP-RERA) was established to protect homebuyers, ensure transparency, regulate developers and agents, and bring accountability to every real estate transaction.

Section 54F: A Smarter Way to Save LTCG Tax

When you sell long-term investments, such as shares, mutual funds, gold, or land, the resulting profits are classified as long-term capital gains (LTCG).

TG-RERA Portal: How to Check Project Registration & Compliance in Telangana

The Telangana real estate sector has grown rapidly over the past decade, increasing the need for transparency, regulation, and accountability.

Bhoomi RTC Karnataka: How to Search, Download & Use Your Land Records

Almost every land-related process in Karnataka begins with one document: RTC (Record of Rights, Tenancy and Crops), also known as Pahani.

Stamp Duty & Registration Charges in Rajasthan – Step-by-Step Guide

Buying a property in Rajasthan involves more than selecting the right location or negotiating the price.

Tamil Nadu RERA (TNRERA): How to Use the Portal, Check Projects & Understand Developer Fee Structure

Buying property in Tamil Nadu can be taxing.

RBI Card Tokenisation Rules: What Users Must Know in 2026

If you shop online, pay on apps, or keep your card “saved” on your favourite platforms, RBI’s card tokenisation rules are the reason your card experience looks different today than it did a few years ago.

UP Bhulekh Portal: How to View & Verify UP Land Records Online

Accessing UP land records has always been complicated and time-consuming.

Stamp Duty & Registration Fee in West Bengal – What Every Buyer Should Know

Buying a home in West Bengal involves more than just negotiating the property price.

Haryana RERA: Registration, Developer Fee Structure & Buyer Checklist

The Haryana Real Estate Regulatory Authority (Haryana RERA) was established to bring transparency, accountability, and protection to the state’s property market.

Apna Khata & Bhunaksha Rajasthan: How to Check Land Ownership & Download Records Online

Land ownership verification in Rajasthan has become much easier with the digitisation of land records under the Apna Khata Rajasthan portal.

What Is an E-Passbook and How to Use It for Digital Banking?

In most Indian homes, the bank passbook used to be a permanent fixture, tucked into a plastic cover, carried carefully to the branch, updated by a printer, and then filed away again.

Ente Bhoomi Kerala – Your Guide to Viewing Land Records Online

Buying land or verifying property ownership in India has always been a complex process.

AnyRoR Gujarat: A Comprehensive Guide to Access Your Land Records Online

Land records are some of the most important documents an individual or business interacts with.

Stamp Duty & Registration Fee in Kolkata (West Bengal) Explained

Buying property in Kolkata? Beyond the builder’s quote or resale price, any new property also needs a budget for stamp duty and registration fees

Stamp Duty & Registration Charges in Telangana – Rates, Buyer Guide & What to Expect

Buying property in Telangana today means dealing with more than just a sale price.

EMI vs Tenure: How Smart Borrowers Can Save Big on Interest

Borrowing has become an essential part of modern financial planning. People take loans for business expansion, home construction, education, personal needs, and working capital.

Stamp Duty & Registration Charges in Kerala: Complete Guide for Buyers

Buying property in Kerala comes with a very specific set of government charges.

Stamp Duty & Registration Charges in Uttar Pradesh

Stamp duty and registration charges form one of the most important cost layers in any property transaction in any state.

What’s the Stamp Duty & Registration Charge in Gujarat? Homebuyer Essentials

When buying a home, each state has its own set of rules and Gujarat is no exception.

Property Registration Charges in Chennai: A Buyer’s Guide for Stamp Duty & Fees

Buying property in Chennai, whether it’s a 1BHK apartment in Anna Nagar or a villa in ECR, doesn’t end with just the sale price.

Decoding the Digital Personal Data Protection Act, 2023

The Digital Personal Data Protection (DPDP) Act, 2023 is India’s first comprehensive digital privacy law.

Stamp Duty & Registration Fees in Tamil Nadu – Rates, Updates & Buyer Checklist

In any state every property purchase is marked by an important legal ritual: paying the stamp duty and registration fee.

Stamp Duty & Registration Fees in Mumbai (Maharashtra) – Rates & How to Pay

Buying property in Mumbai is a significant financial milestone and a complex legal transaction that demands precision.

Maharashtra Stamp Duty & Registration Fee – How to Calculate & What to Expect

Every home, plot, or building purchased in the state whether in the bustling centre of Pune or the quiet periphery of Chandrapur must pass through two official gates before the buyer becomes its lawful owner: stamp duty and registration.

RBI Sachet Portal: How to File a Complaint Against Financial Scams

Financial frauds have become increasingly common, especially in the age of online banking, mobile loan apps, digital investment platforms, and quick-profit schemes shared through social media.

Stamp Duty & Registration Charges in Delhi: What Homebuyers Need to Know

Stamp duty is a mandatory tax paid to the Delhi government when a property is purchased or transferred.

Stamp Duty & Registration Charges in Andhra Pradesh – What Every Buyer Should Know

Stamp duty is a state-imposed tax collected at the time of transferring ownership of property from one person to another.

What is the Latest GST Rate on Purchase of Property in India?

Buying a home is a dream for many, but it comes with its share of taxes and paperwork.

Occupancy Certificate in Bangalore: Importance, Process & New Rules

Occupancy Certificate (OC) is a critical document certifying that a new building is safe and legal to occupy.

New Credit Loss Norms: Why RBI’s Long Transition Period Is Good News for Banks

The Reserve Bank of India (RBI), with the introduction of new Expected Credit Loss (ECL) norms, is aiming further to modernize the country’s banking framework.

10 Common Bank Transactions That Can Draw the Income Tax Department’s Attention

Many taxpayers assume that simply filing their returns on time keeps them off the radar of the Income Tax Department. The reality, however, is more complex.

Choosing Between Regular Pension Plans, NPS Lite & Atal Pension Yojana After New PFRDA Update

For decades, a pension meant a fixed monthly income, guaranteed by the government or employer

Account Nomination Rules Change from November 1, 2025: What It Means for Account Holders and Families

From November 1, 2025, new nomination rules under India’s banking law will come into effect.

New PMLA Rules for Overseas Investments: How to Stay Compliant

Investing abroad was once considered a simple diversification move.

Kisan Vikas Patra vs National Savings Certificate vs Bank FD: Choosing the Right Option

For generations, Indians have valued saving as much as earning.

Turn Your Gold’s Value into Opportunity: Why Dhanteras Is the Right Time for a Gold Loan

Every Dhanteras, millions of Indians bring home gold and silver to mark the arrival of prosperity.

EPFO’s Pension Withdrawal New Rules Are Here: 100% Withdrawals, Fewer Penalties, and Faster Claims

The Employees’ Provident Fund Organisation (EPFO) has approved a wide set of reforms aimed at simplifying withdrawals, reducing employer penalties, and digitizing pension services.

ITR Refund Processed but Not Credited? Here’s What May Be Causing the Delay

Many taxpayers in India are eagerly awaiting their income tax refunds for the 2025 assessment year, only to encounter unexpected delays.

UPI AutoPay: Using It to Manage EMIs and Subscriptions Effectively

UPI has already changed the way India pays, instant, secure, and accessible to everyone with a smartphone.

GST Rate Rationalisation: Impact on Real Estate Prices & Construction Costs

India's Goods and Services Tax (GST), introduced in 2017, is a significant indirect tax reform.

RBI’s New Digital Payment Authentication Rules: Risk-Based Checks Beyond 2FA Explained

The Reserve Bank of India has released a fresh set of directions that define how digital payments in India are verified. RBI released a circular on 25 September 2025, Titled the Authentication Mechanisms for Digital Payment Transactions Directions, 2025.

CBDT Extends Tax Audit Deadline to October 31, 2025: What Businesses Should Know

The Central Board of Direct Taxes (CBDT) has extended the due date for furnishing tax audit reports for FY 2024–25 (AY 2025–26).

Top 10 Common Uses of a Cancelled Cheque in Banking

A cancelled cheque may look like a normal piece of paper with two lines and the word “Cancelled” written across it.

UPI Lite, UPI Lite X & Regular UPI: Step-by-Step Guide to Set Up UPI Lite & Lite X

India’s Unified Payments Interface (UPI) moves billions of transactions worth trillions of rupees every month, but the heart of that growth lies in everyday micro-payments—the ₹20 chai, the ₹80 auto fare, the ₹150 grocery run.

What Really Happens When a UPI Payment Fails (and How to Get Your Money Back)

A failed UPI payment can be unnerving, especially when the amount gets debited but doesn’t reach the receiver.

Top 10 Tips to Protect Yourself from Digital Banking Frauds

According to the Reserve Bank of India (RBI), reported digital banking fraud cases in the financial sector rose from 13,564 in FY23 to 36,075 in FY24—an increase of more than 165% (RBI Annual Report 2023–24).

How to Check Land Records Online Using ULPIN

Land ownership disputes and fraudulent sales remain some of the biggest hurdles for property buyers in India.

RBI’s Home Loan Rules & Outlook: Repo Cut, Prepayment Freedom & What Borrowers Must Know

In December 2025, decided to cut the repo rate by 25 basis points that brought the benchmark down to 5.25%.

UPI Payments Without Internet: How Offline UPI is Changing Digital Payments in India

UPI is India’s crown jewel in digital finance. In June 2025 alone, it clocked over 18.39 billion transactions worth ₹24.03 lakh crore in payments. But here’s the surprise: a large chunk of Indians still struggle to use UPI because they don’t have a stable internet or even smartphones.

New e-Aadhaar App Promises to Simplify Aadhaar Updates

The Government of India is working on simplifying Aadhaar updates through a new mobile application being developed by the Unique Identification Authority of India (UIDAI).

How Digital Banking Tools is Simplifying Finance for Senior Citizens

For senior citizens, managing finances should be simple, stress-free, and secure.

Your Dream Ride Just Got Cheaper: Tax Relief & Accessible Two-Wheeler Loans

India’s Goods and Services Tax (GST) regime has just undergone one of its most impactful revisions, popularly dubbed GST 2.0, and it’s set to take effect on September 22, 2025.

Filing Late ITR: What Happens If You Miss the Deadline?

September 16, 2025, was the due date for filing Income Tax Returns (ITR) for individuals not required to undergo an audit.

Dussehra 2026: How to Win Your Financial Battles with Smart Saving

Dussehra is remembered as a victory of what’s steady and principled over what’s chaotic and impulsive.

eSIM Scam in India: I4C Warns Mobile Users About Rising Fraud – How to Stay Safe

The Indian Cybercrime Coordination Centre (I4C), a wing of the Ministry of Home Affairs, issued a strong warning to mobile users about the rapid increase in eSIM fraud in India.

How to Link PAN with Aadhaar: Step-by-Step Guide & Consequences of Not Linking

Linking your Permanent Account Number (PAN) with your Aadhaar is no longer just a best practice.

Annual Information Statement (AIS): A Complete Guide for Stress-Free ITR Filing

India’s tax season is in its final stretch.

ITR-1 (Sahaj) Restrictions: Income Sources Not Allowed & Filing Rules

With just a few days left before the 15 September 2025 deadline for filing Income Tax Returns (ITRs) for Assessment Year (AY) 2025-26, many taxpayers are rushing to submit their forms online.

GST Rate Cut on Electronics: What It Means for Consumers and Retailers

India’s Goods and Services Tax (GST) system has entered a new era with the rollout of GST 2.0, effective from September 22, 2025.

Banking Safety Guide: How to Avoid QR Code Frauds While Making Payments

India’s love for QR code payments has made transactions lightning-fast, but also opened a new front for cybercriminals.

Scam Alert! Phishing, Vishing, and Smishing Can Drain Out Your Finances

Digital banking in India has transformed the way we manage money.

India’s New GST Reform Bill: What GST 2.0 Means for You

India’s indirect tax system is entering a landmark new phase.

Capital Adequacy Ratio (CAR): Meaning, Formula, and RBI Norms

Banks run on trust — but trust alone cannot guarantee stability. A sudden surge in bad loans or a market shock can quickly weaken even the largest institutions.

ITR Filing Penalties: What You’ll Pay in Fees, Interest, and Compliance Costs

The Income Tax Department extended the ITR filing deadline for FY 2024–25 to September 15, 2025, giving taxpayers a second chance after the original due date lapsed.

Marginal Tax Relief for FY 2025-26: How India’s New Rule Helps You Save Income Tax

The Union Budget 2025 introduced a major income tax relief for the middle class – making annual incomes up to ₹12 lakh completely tax-free* under the new regime.

APK Fraud: How One Wrong Download Could Empty Your Bank Account

Picture this. You’re sipping your evening tea when your phone rings.

Gold Loan LTV Ratio Explained (75% to 85%): What It Means for Borrowers

In June 2025, the Reserve Bank of India (RBI) introduced a significant relaxation for gold loan borrowers: the maximum Loan-to-Value (LTV) ratio for loans below ₹2.5 lakh was raised to 85%, up from the long-standing cap of 75%. Loans between ₹2.5 lakh and ₹5 lakh can now go up to 80%, while loans above ₹5 lakh continue under the 75% ceiling.

Good Debt vs Bad Debt: Learn the Difference

Every month, millions of Indians wait for the familiar debit alert, an EMI deducted from their account.

Got a Tax Refund? 5 Smart Ways to Put Your 2025 Refund to Work

For many taxpayers, there’s a unique sense of relief when a tax refund arrives.

Credit Score Not Improving? 5 Mistakes You Might Be Making

For most of us, a credit score feels like a silent judge sitting in the background of our financial lives.

Banking Jargon Decoded: 15 Key Terms You Should Know

Banking feels simple on the surface; deposit money, withdraw when needed, pay bills, or transfer funds.

The ₹10 Lakh Rule for Cash Deposit Explained

Every day, millions of Indians walk into their banks to deposit cash, sometimes a few thousand rupees, sometimes several lakhs.

Missed Income or Errors? Here’s How ITR-U Can Save You from Penalties

Less than three weeks remain before the September 15 deadline to update income tax returns.

This Current Account is Designed to Empower Your Business

In the fast-paced world of business, having the right bank account can be a game-changer.

Digital Arrest: The Scam That Has Financially Affected Thousands Across India

Imagine receiving a video call from someone in uniform, flashing a government ID, and telling you that a parcel in your name has been caught carrying drugs or illegal documents.

The Impact of EBLR & MCLR on Your Home Loan Explained

On 6 August 2025, The Reserve Bank of India unanimously decided to pause its repo rate at 5.50%.

Business Loan vs Overdraft: Which One Is Right for MSMEs?

Despite MSMEs critical role in the economy, they often face a daunting challenge—access to timely and suitable credit.

Digital Rupee: What India’s CBDC Means for You

India has created a completely new form of money, and it’s not a cryptocurrency.

Income-Tax (No. 2) Bill, 2025: What the New “SIMPLE” Law Means for Taxpayers

On August 11, 2025, the Lok Sabha approved the Income‑Tax (No. 2) Bill, 2025, setting in motion the most sweeping overhaul of India’s direct tax law in more than six decades.

Switching to a New Bank for Savings Account? Consider These Tips

Top 5 Financial Planning Tips for First-Time Earners

Explore 5 smart financial planning tips for first-time earners.

Budgeting Made Easy: Tips for Maximizing Your Savings Account Interest Earnings

Let’s be honest; most of us don’t really use our savings accounts to its full potential.

How Recurring Deposits Help You Build a Savings Habit

Saving money sounds easy, until you try to do it every month. Life keeps throwing expenses at you, and before you know it, the idea of saving becomes a “next month” plan.

What Makes Agriculture Loans Different from Regular Credit Lines

At first glance, all loans may look the same. They provide money when you need it and expect repayment with interest.

How Pisciculture Loans Help Boost India’s Blue Economy

India’s economic future doesn’t lie only in its cities or industries—it also flows through its rivers, lakes, and coastline.

New UPI Rules Effective August 1, 2025: What Every User Needs to Know

Starting August 1, 2025, major updates to UPI (Unified Payments Interface) usage rules will come into effect across all apps and banks.

How Ujjivan’s High-Interest Savings Accounts are Breaking Traditional Banking Norms

Savings accounts have long been seen as the safest place to keep money you’re not using, right away.

Nominee and Joint Account Features in Savings & Current Accounts

Most people think opening a bank account is a one-time task.

Need a Loan with Minimal Documentation? Apply for a Gold Loan

For decades, gold might have sat quietly in your lockers—passed down through generations, worn on special occasions, and kept aside “just in case.” Today, that “just in case” is being redefined.

How MSME Loans Are Tailored for First-Generation Entrepreneurs

Starting your own business can be exciting.

Best Current Account for E-commerce Businesses in India: A Complete Guide

Running an e-commerce business in India with a population that tops the world, comes with heavy decisions.

Current Account Just Got Smarter with Auto-Sweep to Fixed Deposits

Imagine if the money sitting idle in your current account could start earning interest without you having to lift a finger.

Step-by-Step Guide: How to Link Your Current Account with Google Pay

Any business must set up an effective system for receiving and monitoring payments.

How to Link Your Savings Account with UPI & Mobile Wallets

The majority population of India has shifted to digital payments.

Step-by-Step Guide on How to Check Karnataka RERA Registration Number Online

The Real Estate (Regulation and Development) Act, 2016 (RERA) was enacted to bring accountability and transparency to India’s real estate sector.

Overconfidence Bias and Its Cost in Investing

Overconfidence is a well-documented behavioural bias in finance – often described as an “illusion of control” where investors overestimate their ability to predict or influence market outcomes.

What Makes a Savings Account Ideal for First Time Earners?

Starting your first job or gig is an exciting milestone. With your first earnings or salary in hand, one of the biggest questions is: "Where should I keep my money?"

How to Avoid Ineligible Deduction Claims While Filing ITR

Filing your Income Tax Return (ITR) for the financial year 2024-25 (Assessment Year 2025-26) requires careful attention to detail.

ITR-1 vs ITR-2: Understanding the Difference and Choosing the Right Tax Form

Filing your income tax return in India requires using the correct ITR form.

How Jewellers in India Calculate Gold Price

Gold jewellery holds a special place in Indian culture, often bought during festivals and family celebrations.

How to Link Your Mobile Number with Aadhaar Online & Offline Methods

Linking your mobile number with Aadhaar is essential if you want to access Aadhaar-based services like e-KYC and Video KYC for bank accounts, OTP verification, filing taxes, e-Aadhaar downloads, and biometric authentication. Without a registered mobile number, you can't use any online Aadhaar services.

The Importance of Property Insurance When Taking a Home Loan

A home loan is a long-term financial commitment often spanning between 10 to 20 years, or even more.

Fixed Deposits vs Sovereign Gold Bonds (SGB): Which Is the Better Investment?

In today’s uncertain economic climate, conservative and low-risk investment options continue to dominate the choices of Indian savers.

FD vs SIP: Not a Race, But a Financial Match

We often treat money like a race — chasing returns, tracking trends, comparing who’s earning more from what.

Understanding ITR-1 (Sahaj) vs ITR-4 (Sugam)

When you file your income tax return in India, you must choose the right ITR form. Two common forms for small taxpayers are ITR-1 (Sahaj) and ITR-4 (Sugam).

Need Extra Funds? Here’s Why a Pre-Qualified Top-Up Home Loan May Be the Answer

Life doesn’t come with a warning. Whether it’s a sudden medical bill, your child’s higher education, or long-overdue home renovations, unexpected expenses can put anyone under emotional and financial pressure.

The ABC of Taxation in India: A Beginner’s Guide to Taxes, Deductions & Compliance

Do your payslips often confuse you? Wondering why a part of your hard-earned income disappears every month or how some people seem to “save taxes” legally?

Forex Fluctuation Relief for NRIs: Why Clause 72(6) Changes the Game

If you're an NRI investing in Indian start-ups or private companies, chances are you've paid more tax than you should have. Not because you made too much money, but because of how the rupee behaves.

Form 15G vs Form 15H: Key Differences & How to Use Them

If you earn interest from bank deposits, bonds, or other sources, banks will deduct TDS (tax deducted at source) once your interest crosses a threshold.

Senior Citizens Can Still Earn Up to 7.95% Interest on FDs Despite Falling Rates

The interest rate landscape in India is changing. The Reserve Bank of India (RBI) recently reduced the repo rate to 5.25%, its fourth rate cut this year.

Hindu Undivided Family (HUF) Slabs, Deductions & Filing Tips for FY 2025–26

Every year, families across India file their income tax returns often under individual names, sometimes missing out on a hidden advantage already built into the system - The Hindu Undivided Family (HUF).

Tax Benefits of the National Pension System (NPS) for FY 2024–25

The National Pension System (NPS) is a government-backed retirement savings scheme that lets you build a pension corpus during your working years. One of its biggest attractions is the tax savings it offers on contributions.

TDS and Taxation on Business Current Accounts: Latest Updates

Running a small business means handling cash and bank transactions carefully. In India, any large cash withdrawal from a business current account can trigger TDS (Tax Deducted at Source) under Section 194N of the Income Tax Act. These rules are designed to curb black money and promote digital transactions.

Planning to Have Multiple Current A/c for the Same Business? Check These Guidelines

You may wonder why a business might want more than one current account. In practice, having multiple accounts can help with cash-flow management and organization. For example, one account might be used for receiving payments, another for payroll, or separate accounts for different divisions or projects.

How to Calculate Home Loan EMI via EMI Calculator and Excel Sheet

Before applying for a home loan, it’s important to know exactly how much you’ll be paying each month, and that’s why you need to calculate home loan EMI beforehand to know exactly how much you are being committed to.

RBI Revises KYC Rules: Easier Updates and Access to Funds

In June 2025, the Reserve Bank of India (RBI) announced a major overhaul of its KYC (Know Your Customer) norms. Under the new guidelines, banks must simplify periodic KYC compliance so that customers – especially those in rural or underserved areas – can easily access their own funds.

Why You Could Receive Higher Interest on Tax Refunds in 2025

If you’re expecting a tax refund this year, here’s some good news, you might receive more than you originally anticipated. Thanks to the Income Tax Return (ITR) deadline extension for the assessment year 2024–25, the interest component on your tax refund could be higher than usual.

Digital Awareness: How to Identify Fake Income Tax Emails

You might be sipping your morning coffee, scrolling through your inbox, and suddenly—an email from the Income Tax Department pops up.

TDS Tips for Businesses: A Sector-Specific Guide for Agro Enterprises & Startups

Tax Deducted at Source (TDS) might seem like just another compliance box to check—but TDS for start-ups and agro-businesses, can have far-reaching consequences.

How Form 15G Helps You Avoid TDS on Fixed Deposits & When to Submit It

If you're someone who earns interest from fixed deposits (FDs) but your total income is below the taxable limit, there's a good chance you're losing money unnecessarily to TDS.

ITR Filing Deadline Extended to September 15, 2025: What Taxpayers Need to Know

If you’re among the many taxpayers in India preparing to file your Income Tax Return (ITR), there’s some good news: the ITR deadline has been officially extended.

How to File ITR-1 Online: A Step-by-Step Guide

Income Tax Return – 1 (ITR-1), also known as Sahaj (meaning "easy" in Hindi), is the simplest income tax return form for individual taxpayers in India.

Co-Applicant in Home Loan: Benefits & Rules You Should Know

Buying a home is often a family decision, and financially, it can be a big one. To make it easier, many people apply for a joint home loan by adding a co-applicant.

Introducing Ujjivan Rewardz: Banking That Rewards You

At Ujjivan Small Finance Bank, we believe your loyalty deserves to be rewarded. That's why we've created Ujjivan Rewardz, a loyalty program that adds value to your everyday banking.

Why You Should Book Your Fixed Deposit Now, Before FD Rates Are Cut

The Reserve Bank of India (RBI) has recently cut the repo rate by 25 basis points, bringing it down to 5.25% (data as on December 2025).

Cash Deposit Limits in Business Current Accounts: An In-Depth Guide

Managing cash deposits is a crucial aspect of business banking. Different types of current accounts come with varying limits on free cash deposits and associated charges.

Decoding Banking Jargons: What is Amortization Schedule?

Mr. X, a 32-year-old IT professional in Pune, finally decided to buy his dream 2BHK flat. After months of site visits, he zeroed in on a ₹75 lakh apartment and got a home loan of ₹50 lakhs for 20 years at an interest rate of 8% p.a. He decided to make a down payment of the remaining ₹25 lakh from his own pocket.

Fixed Deposit vs. Post Office Time Deposit: Which One Should You Choose?

Fixed deposits are among the most trusted investment options in India. They offer safety, steady returns, and are easy to understand.

Home Loan Transfer Process in India: Step-by-Step Guide to Switching Your Loan Account to Another Bank

A home loan is a long-term commitment, and over time, your financial needs or market conditions may change.

New Gold Loan Rules Soon? RBI Drafts Guidelines

If you’re planning to apply for a gold loan, there are some important changes on the horizon.

8 Types of Savings Accounts You Should Know

As of 2025, India boasts over 2.5 billion bank accounts – a testament to widespread banking access.

Best Guide on How to Choose the Right Current Account for Your Business

In today's dynamic business environment, selecting the appropriate current account is important for efficient financial management.

MythBuster: Do You Need to Have a Savings Account to Open an FD?

Think you must have a savings account before opening a Fixed Deposit (FD)?

Can You Get a Home Loan Without Down Payment?

Buying a home is one of the biggest financial milestones in life. For most Indians, this dream is realised through a home loan, which helps spread the cost of the property over several years.

Home Insurance vs Home Loan Insurance: A Detailed Guide

As of September 30, 2024, total outstanding individual housing loans stood at ₹33.53 lakh crore (₹33.53 trillion), marking a 14 % YoY increase amid a post‑pandemic housing boom.

Is There Any Penalty If You Foreclose or Prepay Your Home Loan?

Did you know nearly 40% of home loan borrowers in India prefer prepaying their loans partially or fully within the first 10 years to save on interest costs? With rising financial awareness and better income visibility, prepaying a housing loan has become a go-to strategy for faster debt freedom.

ATM Withdrawal Charges in India: New RBI Rules Effective May 1, 2025

If you frequently use your debit card at ATMs—whether for cash withdrawals or balance inquiries—it is important to be aware of recent ATM withdrawal charges and regulatory changes.

What is In-Principle Approval in Home Loan?

Buying a home is one of the biggest financial decisions most people make in their lifetime. While shortlisting properties and budgeting are crucial steps, securing a home loan is often the key that unlocks the dream of homeownership.

Top Government Housing Schemes for First-Time Home Buyers in India (2025 Guide)

For first-time homebuyers, the process of purchasing a home can be overwhelming due to increasing property prices and complex loan eligibility requirements.

Complete List of Common Types of Bank Accounts in India

As of 2024, India has over 2.2 billion bank accounts, a testament to the country’s rapid financial inclusion and evolving banking habits.

Best Investment During a Volatile Market? Fixed Deposits Could Be It

When the equity markets tumble, crypto takes a nosedive, and even gold shows inconsistent trends, Indian investors often turn to one of the most traditional instruments: Fixed Deposits (FDs).

Tips to Consider Before Opening a Current Account

As of early 2025, India has over 10 crore active current accounts, with digital current accounts alone witnessing a 42% year-on-year growth—driven by small businesses, freelancers, and start-ups.

6 Ways Mr. X Raised His CIBIL Score from 500 to 750

In India, more than 79% of loan approvals are granted to individuals with a credit score of 750 or above, according to CIBIL’s – one of the largest credit bureaus responsible for collecting and maintaining credit-related data of individuals and businesses - latest insights.

Top Mistakes to Avoid When Choosing a Current Account for Your Business

India's economic landscape in 2025 presents both opportunities and challenges for businesses. The country's current account deficit (CAD) stood at $11.5 billion, or 1.1% of GDP, in the third quarter of fiscal year 2024-25, reflecting a manageable economic environment.

KYC Meaning and Process Explained

In today's rapidly digitizing world, Know Your Customer (KYC) has become more than a regulatory formality — it’s the foundation of trust between institutions and users.

Why Akshaya Tritiya Is the Ideal Time to Open a Savings Account

Akshaya Tritiya, often hailed as one of the most auspicious days in the Hindu calendar, symbolises unending prosperity, success, and growth.

Earn Higher Interest Rates on Fixed Deposit with This Account

The RBI’s Monetary Policy Committee cut the repo rate by 50 basis points to 5.50% in its June 2025 meeting, marking the second consecutive reduction within six weeks to support growth amid benign inflation.

RBI’s New Rules for Savings Accounts for Kids: A Big Push Towards Early Financial Empowerment

The Reserve Bank of India (RBI) has taken a significant step towards financial empowerment of minors by issuing a fresh set of guidelines on the opening and operation of deposit accounts by children.

Best Current Accounts in India: Simplify Your Business Transactions

In the fast-evolving world of Indian business, having a reliable current account is more than just a financial necessity—it’s a strategic asset.

Top Savings Account Schemes to Start the New Financial Year 2025–26

The beginning of a new financial year isn’t just about filing taxes or revisiting your investment strategy—it's also the perfect time to re-evaluate where you park your money.

Disappointed with Your Savings Account? Switch to This Small Finance Bank

In April 2025, following the Reserve Bank of India’s (RBI) repo rate cut to 5.50%, several major banks have reduced interest rates on savings accounts.

7 Steps to Get Started Your Home Loan Application Process in India

Buying a home is one of the biggest dreams for most of us. But with rising property prices, it's not always possible to pay the full amount upfront. That’s where a home loan in India becomes a helpful option.

How to Keep Your Money Growing in a Volatile Market: A Comprehensive Guide

The Indian financial landscape in early 2025 has been quite unpredictable. According to Reuters, equity mutual fund inflows slumped to an 11-month low in March 2025 due to growing concerns around sectoral imbalances and global uncertainties.

Is Closing Your Home Loan Early Good or Bad for Your Credit Score?

In the world of personal finance, owning a home is often seen as the pinnacle of financial stability.

Telangana Housing Board & KPHB Colony: A Guide to Affordable Urban Housing in Hyderabad

As Telangana continues its rapid urbanisation journey, two key housing entities—Telangana Housing Board (THB) and Kukatpally Housing Board Colony (KPHB)—have played critical roles in shaping the state's real estate ecosystem.

Does Checking CIBIL Score Frequently Lower Your Credit Points?

Imagine you're planning to apply for a home loan, a credit card, or even a car loan. Naturally, you want to ensure your CIBIL score is in good shape before proceeding.

Explained: Can NRIs Buy an Agricultural Land in India?

Real estate investment is often a top priority for Non-Resident Indians (NRIs) looking to retain strong financial ties to India.

How to Improve Your CIBIL Score from 600 to 750: A Step-by-Step Guide

Your CIBIL score is like your financial reputation—banks check it before approving loans or credit cards. If your score is hovering around 600, you might face difficulties in securing credit or may get loans with higher interest rates.

What Happens When You Leave Your Savings Account Unused?

Imagine waking up one day to find that your hard-earned money is locked away and inaccessible. Sounds stressful, right? This is precisely what happens when you leave your Savings Account inactive for too long.

Unified Pension Scheme (UPS): Everything You Need to Know

The Pension Fund Regulatory and Development Authority (PFRDA) has announced the Unified Pension Scheme (UPS) will be operational from April 1, 2025.

What Does DPD Mean in CIBIL Report?

Your CIBIL report is like a financial passport that determines your credibility as a borrower. Whether you’re applying for a home loan, personal loan, or even a credit card, lenders will carefully review your CIBIL report before making a decision.

Are You Eligible for Section 80EE or Section 80EEA Tax Benefits?

Imagine this: Ravi, a young IT professional in Bangalore, has just booked his dream home. While planning his finances, he hears about tax benefits under Section 80EE and Section 80EEA but is confused about which one applies to him.

First Salary? 10 Smart & Fun Ways to Make It Count!

That magical moment has arrived—you’ve received your first salary! It’s not just money; it’s your hard-earned reward for months (or years) of effort, learning, and persistence.

Difference Between Income Tax and TDS Explained

Understanding taxation is crucial for every individual and business in India. Two of the most common terms that taxpayers come across are Income Tax and Tax Deducted at Source (TDS).

Understanding Primary and Collateral Security in Business Loans: Key Differences and Implications

Securing a business loan often involves pledging assets to assure the lender of repayment. These assets can be categorized as primary or collateral security, each serving a unique purpose in the lending process.

Term Deposits Vs. Fixed Deposits: Know the Difference

Rohan, a young professional, is looking for a safe place to park his savings. He wants guaranteed returns but is torn between two options—Term Deposits (TDs) and Fixed Deposits (FDs).

Tax on Savings Account Interest: The Fine Print You Can’t Ignore!